DigitalBridge Group, Inc. | REIT Profile

Symbol: DBRG

CIK: 1679688

Exchange: NYSE

Preferred Stock: DBRG-H, DBRG-I, DBRG-J

HQ: New York, NY, United States

Type of REIT: Equity REIT

Listing Status: Public

Market Capitalization: Small-Cap

REIT Sector: Data Centers, Infrastructure

See DBRG on Yahoo Finance

See DBRG on SEC.gov

A Fast-Growing Global Investment Firm That Owns, Operates, and Invests Across the Full Spectrum of Digital Infrastructure. DigitalBridge is the only dedicated, global-scale digital infrastructure firm investing across five key verticals: data centers, cell towers, fiber networks, small cells, and edge infrastructure. Our platform manages $88 billion* on behalf of its limited partners and shareholders and is focused on identifying differentiated investment opportunities within digital infrastructure around the world. DigitalBridge is a unique digital infrastructure business, with both the operating DNA and access to institutional capital that positions the firm to execute globally on a converging digital infrastructure ecosystem. It is a business that owns and invests in real assets exposed to resilient, growing markets led by a pioneering team that has been investing successfully in the sector for over two decades.

Stock Chart

REITRating™ Trend

REITRating™ is REITNotes' Real Estate Investment Trust industry-specific rating and ranking system. The overall score is out of ten points, with ten being the best score. See score breakdown. The graph below plots the overall REITRating™ score for the last trading days. See complete trend.

Dividend of Trading Day 2025-07-01

Annualized Dividend: $0.04*

Dividend Yield (TTM): 0.4%

Annualized Dividend (TTM): $0.04

Ex-Dividend Date: 2025-06-30

Dividend Date: 2025-07-15

Dividend Frequency: Quarterly

*The forward annualized dividend and dividend yield are based on the most recent dividend value paid by the REIT. The REIT may have already announced their next upcoming dividend value, which may be different from previously paid dividend value. It is recommended to check the REIT's website and dividend announcements for the latest information on upcoming dividends and changes. This graph does not include extraordinary dividend.

Latest REIT Press Releases

- DigitalBridge Announces Formation of Edge Data Center Platform in Asia and Acquisition of a Stake in AIMS Group - Tue, 22 Nov 2022 01:16:39 UTC

- DigitalBridge Announces Third Quarter 2022 Financial Results - Fri, 04 Nov 2022 12:31:38 UTC

- DigitalBridge Reinstates Quarterly Dividend - Wed, 14 Sep 2022 13:22:08 UTC

- DigitalBridge Appoints Bernardo Vargas Gibsone as Head of Latin America - Tue, 13 Sep 2022 12:31:48 UTC

- DigitalBridge Completes First Stage of DataBank Recapitalization - Mon, 29 Aug 2022 20:27:21 UTC

Funds From Operations (FFO)

FFO Amount and Payout Ratio

Below are the FFO amounts, dividends, and payout ratios for the last two quarters for DBRG.

| Year | Quarter | Type | Amount | Dividend Paid | Payout Ratio |

|---|---|---|---|---|---|

| 2024 | Q4 | Distributable Earnings | $--- | $--- | ---% |

| 2024 | Q3 | Distributable Earnings | $--- | $--- | ---% |

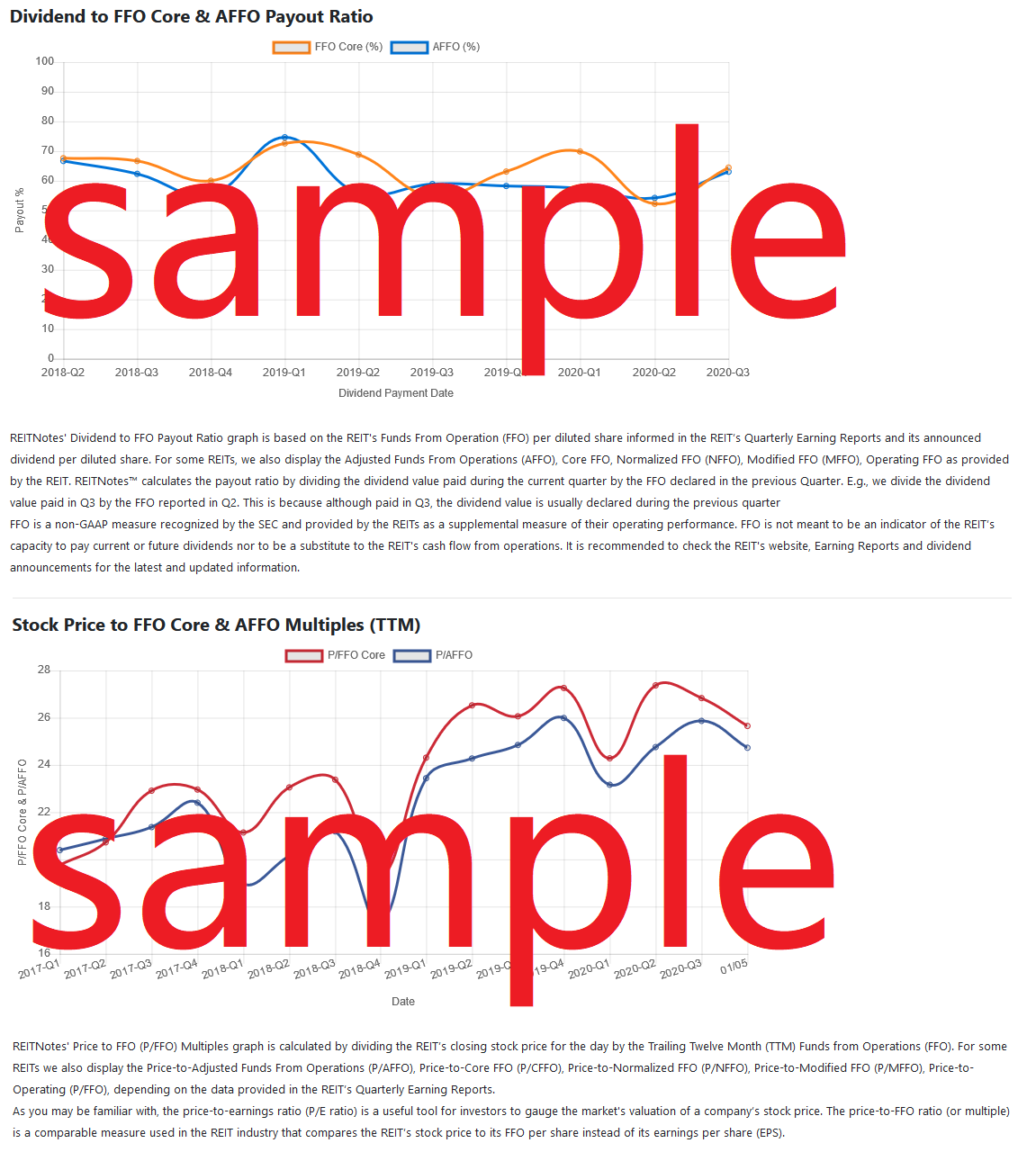

REITNotes uses the REIT's Funds From Operation (FFO) per diluted share informed in the REIT’s Quarterly Earning Reports and its announced dividend per diluted share. For some REITs, we also display the Adjusted Funds From Operations (AFFO), Core FFO, Normalized FFO (NFFO), Modified FFO (MFFO), Operating FFO as provided by the REIT. REITNotes™ calculates the payout ratio by dividing the dividend value paid during the current quarter by the FFO declared in the previous Quarter. E.g., we divide the dividend value paid in Q3 by the FFO reported in Q2. This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT's cash flow from operations. It is recommended to check the REIT's website, Earning Reports and dividend announcements for the latest and updated information.

Key Stats of Trading Day 2025-07-01

EBITDA: $165,654,000 [?]

P/E (Price-to-Earnings) Ratio: 26.54 [?]

PEG (Price/Earnings to Growth) Ratio: N/A [?]

Book Value: 6.62 [?]

Dividend Per Share (DPS): $0.04 [?]

Earnings Per Share (EPS): 0.39 [?]

Revenue Per Share (TTM): $3.31 [?]

Profit Margin: 20.10% [?]

Operating Margin (TTM): -3.60% [?]

Return on Equity (TTM): 6.90% [?]

Revenue (TTM): $566,324,000 [?]

Gross Profit (TTM): $566,324,000 [?]

Diluted EPS (TTM): $0.39 [?]

Quarterly Earnings Growth YOY: N/A [?]

Quarterly Revenue Growth YOY: -40.10% [?]

Trailing P/E: 26.54 [?]

Forward P/E: 83.33 [?]

Beta: 1.72 [?]

Price-to-Book (P/B): 1.57 [?]

Enterprise Value (EV) to Revenue: 4.51 [?]

EV to EBITDA: 11.82x [?]

Shares Outstanding: 176,116,000 [?]

52 Week High: $17.28 [?]

52 Week Low: $6.40 [?]

50 Day Moving Average: $9.96 [?]

200 Day Moving Average: $11.40 [?]

REIT Simulation

Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below.

| With $1,000 USD | With $500 USD | With $250 USD | With $100 USD | With $50 USD | |

|---|---|---|---|---|---|

| Initial investment | @ $13.02 per share you would have been able to buy 76 shares of DBRG on 2024-07-01 costing $989.52 | @ $13.02 per share you would have been able to buy 38 shares of DBRG on 2024-07-01 costing $494.76 | @ $13.02 per share you would have been able to buy 19 shares of DBRG on 2024-07-01 costing $247.38 | @ $13.02 per share you would have been able to buy 7 shares of DBRG on 2024-07-01 costing $91.14 | @ $13.02 per share you would have been able to buy 3 shares of DBRG on 2024-07-01 costing $39.06 |

| Current worth | On 2025-06-30 these 76 shares would be worth $786.60 @ $10.35 | On 2025-06-30 these 38 shares would be worth $393.30 @ $10.35 | On 2025-06-30 these 19 shares would be worth $196.65 @ $10.35 | On 2025-06-30 these 7 shares would be worth $72.45 @ $10.35 | On 2025-06-30 these 3 shares would be worth $31.05 @ $10.35 |

| Dividends earned | $3.80 in dividends would have been earned since 2024-07-01 with 76 shares. | $2 in dividends would have been earned since 2024-07-01 with 38 shares. | $0.95 in dividends would have been earned since 2024-07-01 with 19 shares. | $0.35 in dividends would have been earned since 2024-07-01 with 7 shares. | $0.15 in dividends would have been earned since 2024-07-01 with 38 shares. |

| Net (gain / loss)* | -199.12 USD | -99.56 USD | -49.78 USD | -18.34 USD | -7.86 USD |

| ROI** | -20.12% | -20.12% | -20.12% | -20.12% | -20.12% |

*Net (Gains/Loss): Includes the stock price (appreciate or depreciate ) + dividends earned during period held. Stock prices based on closing price for the date. **ROI: Is based on the Net (gain/loss) divided by the initial investment value. Note: Past performance is no guarantee of future results. This is a high-level simulation and does not account for many factors such as inflation and taxes so we cannot guarantee the accuracy of this simulation.

Dividend History

Below are the most recent cash dividends paid by DBRG. The percent difference from one dividend payment to the next has also been calculated for your convenience. Dividends flagged as [E] are extraordinary dividend payments.

| Symbol | Ex Date | Cash Amount | Change in Dividend | Declaration Date | Record Date | Payment Date |

|---|---|---|---|---|---|---|

| DBRG | 2025-06-30 | 0.010 | --- | 2025-04-25 | 2025-06-30 | 2025-07-15 |

| DBRG | 2025-03-31 | 0.010 | --- | 2025-02-20 | 2025-03-31 | 2025-04-15 |

| DBRG | 2024-12-31 | 0.010 | --- | 2024-10-25 | 2024-12-31 | 2025-01-15 |

| DBRG | 2024-09-30 | 0.010 | --- | 2024-08-06 | 2024-09-30 | 2024-10-15 |

| DBRG | 2024-06-28 | 0.010 | --- | 2024-04-30 | 2024-06-30 | 2024-07-15 |

| DBRG | 2024-03-27 | 0.010 | --- | 2024-02-16 | 2024-03-31 | 2024-04-15 |

| DBRG | 2023-12-28 | 0.010 | --- | 2023-10-27 | 2023-12-31 | 2024-01-16 |

| DBRG | 2023-09-28 | 0.010 | --- | 2023-08-01 | 2023-09-30 | 2023-10-16 |

| DBRG | 2023-06-29 | 0.010 | --- | 2023-04-27 | 2023-06-30 | 2023-07-17 |

| DBRG | 2023-03-30 | 0.010 | --- | 2023-02-17 | 2023-03-31 | 2023-04-17 |

| DBRG | 2022-12-29 | 0.010 | --- | 2022-11-03 | 2022-12-31 | 2023-01-17 |

| DBRG | 2022-09-29 | 0.010 | -90.91% | 2022-09-14 | 2022-09-30 | 2022-10-17 |

Financial Statements Overview

Balance Sheet | Quarterly

| Assets | 2025-03-31 | 2024-12-31 | QoQ |

|---|---|---|---|

| Current Assets | |||

| Cash and Cash Equivalents at Carrying Value | 349,912,000 | 302,154,000 | |

| Short-Term Investments | 0 | 0 | |

| Cash and Short Term Investments | 349,912,000 | 302,154,000 | |

| Current Net Receivables | 7,342,000 | 0 | |

| Inventory | 0 | 0 | |

| Other Current Assets | 0 | 12,567,000 | |

| Total Current Assets | 478,058,000 | 441,963,000 | 8.2% |

| Non-Current Assets | |||

| Property Plant Equipment | 0 | 0 | |

| Accumulated Depreciation Amortization PPE | 0 | 0 | |

| Long-Term Investments | 2,388,618,000 | 2,492,268,000 | |

| Investments | 0 | 0 | |

| Intangible Assets Excluding Goodwill | 66,531,000 | 72,460,000 | |

| Goodwill | 465,602,000 | 465,602,000 | |

| Intangible Assets | 66,531,000 | 72,460,000 | |

| Other Non-Current Assets | 0 | 0 | |

| Total Non-Current Assets | 2,960,970,000 | 538,062,000 | 450.3% |

| Total Assets | 3,439,028,000 | 3,513,318,000 | -2.1% |

| Liabilities | |||

| Current Liabilities | |||

| Current Accounts Payable | 38,671,000 | 0 | |

| Deferred Revenue | 0 | 0 | |

| Current Debt | 0 | 0 | |

| Short-Term Debt | 0 | 0 | |

| Current Long-Term Debt | 0 | 0 | |

| Short Long-Term Debt Total | 0 | 339,713,000 | |

| Other Current Liabilities | 303,000 | 33,843,000 | |

| Total Current Liabilities | 70,300,000 | 60,170,000 | 16.8% |

| Non-Current Liabilities | |||

| Long-Term Debt Noncurrent | 0 | 0 | |

| Long-Term Debt | 296,886,000 | 296,362,000 | |

| Capital Lease Obligations | 43,275,000 | 43,351,000 | |

| Other Non-Current Liabilities | 59,572,000 | 54,509,000 | |

| Total Non-Current Liabilities | 903,963,000 | 961,958,000 | |

| Total Liabilities | 974,263,000 | 1,022,128,000 | -4.7% |

| Shareholders' Equity | |||

| Common Stock | 0 | 0 | |

| Common Stock Shares Outstanding | 176,243,571 | 168,818,000 | |

| Treasury Stock | 0 | 0 | |

| Retained Earnings | -6,840,143,000 | -6,837,502,000 | |

| Total Shareholder Equity | 1,960,767,000 | 1,958,582,000 | 0.1% |

Amounts in USD ($)

Income Statement | Quarterly

| 2025-03-31 | 2024-12-31 | QoQ | |

|---|---|---|---|

| Total Revenue | 45,447,000 | 66,174,000 | -31.3% |

| Cost of Revenue | -22,304,000 | -18,592,000 | |

| Cost of Goods and Services Sold | -22,304,000 | -18,592,000 | |

| Gross Profit | 67,751,000 | 84,766,000 | -20.1% |

| Research and Development | 0 | 0 | |

| Selling General and Administrative | 62,056,000 | 387,524,000 | |

| Depreciation | 0 | 0 | |

| Depreciation and Amortization | 7,226,000 | 8,215,000 | |

| Operating Expenses | 69,282,000 | 84,766,000 | |

| Operating Income | -1,531,000 | 4,027,000 | -138.0% |

| EBIT (Earnings Before Interest and Tax) | -6,471,000 | 9,773,000 | |

| Investment Income Net | 0 | 0 | |

| Net Interest Income | -3,898,000 | -3,981,000 | |

| Interest Income | 0 | 0 | |

| Interest Expense | 3,898,000 | 3,981,000 | |

| Interest and Debt Expense | 0 | 0 | |

| Non Interest Income | 0 | 0 | |

| Other Non Operating Income | 0 | 0 | |

| Income Before Tax | -10,369,000 | 5,792,000 | -279.0% |

| Income Tax Expense | -301,000 | 818,000 | |

| Net Income from Continuing Operations | -10,670,000 | 4,974,000 | |

| Net Income | 13,782,000 | -5,051,000 | -372.9% |

| Comprehensive Income Net of Tax | 0 | 0 | |

| EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | 755,000 | 17,988,000 |

Amounts in USD ($)

Cash Flow | Quarterly

| Cash Flows from Operating Activities | 2025-03-31 | 2024-12-31 | QoQ |

|---|---|---|---|

| Net Income | -14,855,000 | -488,000 | 2,944.1% |

| Depreciation, Depletion, and Amortization | 7,226,000 | 8,215,000 | |

| Change in Receivables | 0 | 0 | |

| Change in Inventory | 0 | 0 | |

| Change in Operating Assets | 0 | 0 | |

| Change in Operating Liabilities | 0 | 0 | |

| Payments for Operating Activities | 0 | 0 | |

| Proceeds from Operating Activities | 0 | 0 | |

| Profit Loss | 0 | 0 | |

| Net Cash Provided by Operating Activities | 50,298,000 | 28,704,000 | 75.2% |

| Cash Flows from Investing Activities | |||

| Capital Expenditures | 306,000 | 283,000 | |

| Net Cash Used in Investing Activities | 0 | 0 | |

| Cash Flows from Financing Activities | |||

| Proceeds from Issuance of Common Stock | 0 | 0 | |

| Proceeds from Issuance of Preferred Stock | 0 | 0 | |

| Proceeds from Issuance of Long-Term Debt | 0 | 0 | |

| Proceeds from Repurchase of Equity | 0 | 0 | |

| Proceeds from Sale of Treasury Stock | 0 | 0 | |

| Repayment of Short-Term Debt | 0 | 0 | |

| Payments for Repurchase of Common Stock | 0 | 0 | |

| Payments for Repurchase of Preferred Stock | 0 | 0 | |

| Payments for Repurchase of Equity | 0 | 0 | |

| Dividend Payout | 14,660,000 | 16,398,000 | |

| Dividend Payout - Common Stock | 14,660,000 | 16,398,000 | |

| Dividend Payout - Preferred Stock | 0 | 0 | |

| Net Cash Provided by Financing Activities | -21,875,000 | -16,922,000 | 29.3% |

| Other Items | |||

| Effect of Exchange Rate on Cash | 0 | 0 | |

| Net Increase in Cash and Cash Equivalents | 0 | 0 |

Amounts in USD ($)

REITRating™ Scorecard

| Rating | Dividend Section | Avg. Rating |

|---|---|---|

| 5 | Dividend Payment Consistency: Analysis of how many periods the REIT’s dividends have been paid consistently without a gap in payment. | 8.0 |

| Rating | AFFO & Efficiency Section | Avg. Rating |

| 3 | Operating Expense Efficiency Trend: Analysis of the trend of the REIT's Operating Expenses to its Revenue. | 8.5 |

| Rating | Leverage Section | Avg. Rating |

| 10 | Debt Leverage Health: Analysis of the REIT’s Total Debt to Total Assets. | 5.2 |

| 10 | Debt Leverage Health Trend: Analysis of the REIT’s Total Debt to Total Assets over the last two years. | 6.7 |

| Rating | Asset & Revenue Section | Avg. Rating |

| 0 | G&A Effeciency Level: Analysis of the REIT’s General and Administrative expenses in relationship to its Revenues. | 6.5 |

| 0 | G&A Effeciency Trend: Analysis of the Trend of the REIT’s General and Administrative expenses in relationship to its Revenues. | 7.5 |

| 0 | Revenues Growth: Analysis of how the REIT's Revenue has performed over the last two years. | 6.1 |

| 0 | Total Asset Growth: Analysis of how the REIT has grown its Total Assets over the last two years. | 5.9 |

| Rating | Properties Section | Avg. Rating |

| Rating | Market Cap Section | Avg. Rating |

| 4 | Market Cap Strength: Analysis of the REIT's Market Capitalization performance, preservation and resistance in comparison to market changes. | 5.3 |

| 5.3 | Overall REITRating™ Score (See trend) | 6.5 |

REITRating is REITNote's Real Estate Investment Trust industry-specific rating and ranking system. The REIT’s score for each analysis is out of ten points, with ten being the best score and zero being the worst. A score of zero can be assigned if the REIT does not meet the criteria for that specific analysis. N/A is assigned if insufficient data is available for a particular analysis. Our REITRating logic is continuously improving, so a REIT’s rating and ranking may change over time. Important Note: REITRating is not a predictor of a REIT’s future performance, it is an evaluation of its past results. Additionally, the REITRating system is for informational purposes only and does not represent financial or investment advice or a recommendation of which REITs to acquire. Learn more.

Last updated: 2025-07-01 - v6.4